Advance payment and you may closing pricing direction software may also be helpful straight down brand new initial will cost you of buying property. This type of apps will vary of the area, therefore speak to your condition construction company observe what you could well be entitled to.

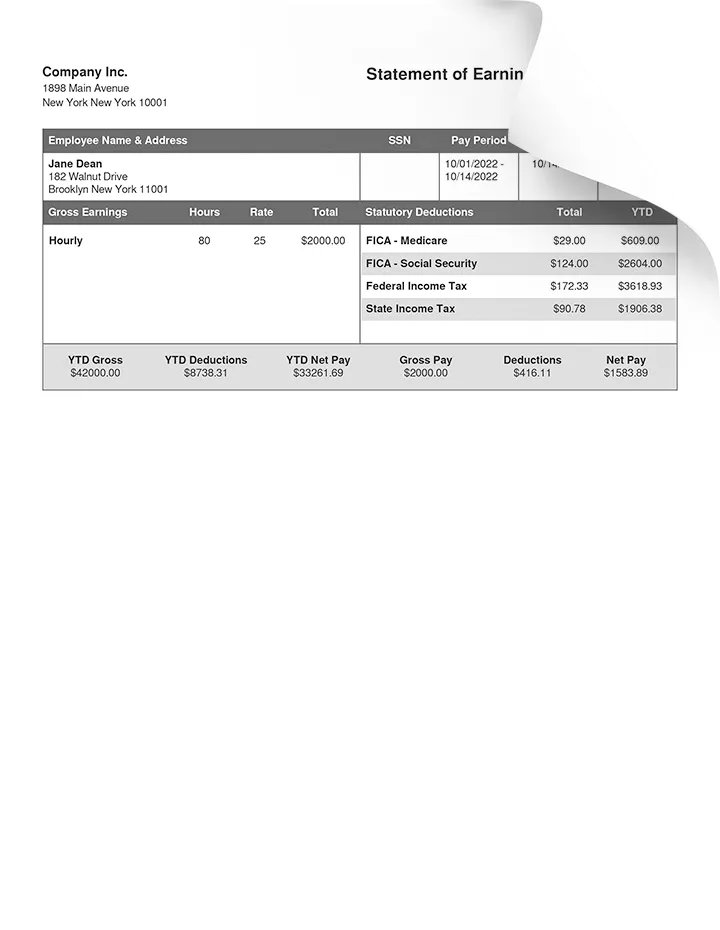

Freddie Mac computer is flexible in the way their deposit as well as your money was acquired. Income will be off old-fashioned W-dos earnings otherwise contracted 1099 income (regardless of if you may need a tax transcript so you can document that it). Keep in mind: The income of the many individuals into the loan might be thought, if you attract a co-debtor, the income would-be considered too. The amount of money limit is actually for this new household’s full shared income.

If you are planning to own some body book a-room otherwise region of the property from you, it’s also possible to make use of your future leasing income to help you be considered you towards loan. To achieve this, the renter cannot be into home loan, need resided to you for around one year, and cannot end up being your spouse otherwise domestic lover. You will also need certainly to provide files regarding paid lease into history 1 year.

In terms of off costs, individuals may use many different types of financing, and cash, gift ideas from relatives, company direction applications, deposit advice money, and also perspiration equity, which is when you really increase the domestic while increasing its value (in the place of an actual downpayment).

What’s Freddie Mac computer House Possible?

Domestic It is possible to is actually a mortgage loan program backed because of the Freddie Mac. The mortgage is made for low-earnings consumers and you can first-date homebuyers with very little coupons. Qualifying customers you would like only a great 3% deposit to utilize the mortgage.

Really does Freddie Mac Family Possible allow boarder earnings?

Sure, you can make use of boarder earnings – or the upcoming income you would expect from a renter about domestic – to be eligible for a home Possible loan. There are specific laws off it, while the renter must have lived along with you for around a-year before you buy of the house. However they can’t be your lady or home-based partner, and you may have to bring files regarding paid off lease to have going back 12 months.

How do i sign up for Freddie Mac’s Household You are able to Virtue?

To apply for an excellent Freddie Mac Domestic Possible home loan, you will need to get a hold of a home loan company that gives old-fashioned financing, then fill in the application. You will must agree to a credit assessment and you can offer various forms off economic documents (the financial will let you know exactly which ones).

Most large banking companies, borrowing from the bank unions, and you may loan providers render traditional funds, along with Home You can mortgages, but definitely look around for your own personal. Rates can vary widely in one to another location. Providing prices away from a number of some other people can allow you to get the lowest priced mortgage repayment you’ll be able to.

Was Freddie Mac computer House Possible for first-big date homebuyers?

First-big date homebuyers can really utilize the Freddie Mac Domestic Possible mortgage, should they meet up with the program’s income criteria. So you’re able to qualify, your children have to generate 80% or lower than the room average domestic income. Freddie Mac computer has actually a qualification unit you need to decide which endurance in your area.

If you do propose to use the Family It is possible to loan due to the fact an initial-go out buyer, you’ll need to complete an excellent homeownership knowledge path first. Freddie Mac computer demands that it if every individuals to your financing tend to become basic-time homebuyers.

What is a Freddie Mac computer Domestic You can loan?

A good Freddie Mac computer House It is possible to mortgage try home financing to possess homebuyers having reduced income or nothing for the savings. Permits to own an effective step three% down payment, and you may loan places Concord mortgage insurance is cancelable after you’ve at the least 20% equity in the home.