We all desire to someday has our very own land. For most people, to acquire a home are a daunting task since it is a great grand financial commitment, and not everyone can manage to do it all at the same time. In order to make this dream an actuality, lenders are a famous option. It can be a difficult highway, however it is maybe not impossible. With many home loans readily available, anyone can safe its best family. But how does one to make an application for housing loans ? Do you know the requirements , as well as how can you choose the right one to?

Knowing what qualifications lenders look for when giving the property mortgage is actually trick. Within blog post, you will understand all about popular qualification standards across the some other financial choices. can banks refinance personal loans We’re going to plus lay out particular products you to definitely apply at being qualified for one to.

What exactly is a mortgage?

Loan providers such as for instance financial institutions and you can mortgage lenders bring lenders, also known as mortgage loans, to help individuals purchase residential property. Since the house are generally costly, we are unable to afford to pay for all of them downright. A mortgage allows consumers so you can borrow cash to invest in a great home and pay the borrowed funds more a specified months, always owing to monthly premiums.

Lenders generate homeownership less costly of the dispersed the purchase price over go out. Before getting a mortgage, potential homebuyers should think about its money, the fresh terms and conditions, and cost of homeownership.

As to why Apply for a construction Loan?

Construction fund can handle very first-go out homeowners and you can property owners seeking to boost their possessions. Homeowners and you will create-feel property owners alike are curious about property funds of the following:

To invest in property

You may be in search of to purchase a good condominium, a house and you can parcel, or even some home. If you are searching to construct your ideal domestic, so it property will be the primary 1st step.

Refinancing a current Financing

You have get a hold of a monetary product with best houses financing criteria and you can terms. Which have family refinancing, that creditor pays the old you to definitely, as well as the debtor takes out a different sort of loan having finest terms on the the brand new financial.

Making use of your Home’s Collateral

Possibly you’re thinking about taking right out a mortgage to pay for biggest requests eg scientific costs, your son or daughter’s college tuition, or a primary journey. Domestic equity funds allows you to borrow funds by using the property value your house since guarantee.

Building a property

This new freedom to construct a home toward an individual’s property was an excellent significant cheer of property control. A mortgage are often used to loans the new building’s build and you will ensure the completion. Next, you can use the borrowed funds to pay for things such as materials, work, and permits.

Improving your Family

When you yourself have property that you are seeking to revision, protecting a homes loan also provide the newest resource required for the repair venture. The mortgage are often used to financing house renovations, restorations, and solutions.

The of those factors, this type of sort of mortgage is definitely the best option to own investment your next domestic or one strategies that will generate the room in addition to this.

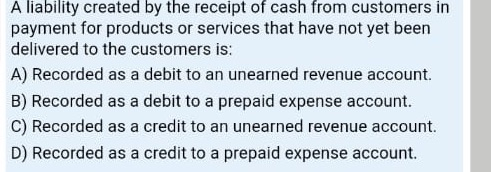

How to Be eligible for a home loan?

The next step, immediately following making sure a property financing is the best treatment for cover your house-related costs, would be to figure out if you qualify for one to.

- If you are a resident of one’s Philippines, you need to be anywhere between 21 and 65 years of age

- When you find yourself an offshore Filipino personnel (OFW), you truly need to have the next:

- another fuel away from attorney

- a duplicate of deal and you will a good POEA-approved certification of employment

- International nationals staying in the new Philippines must provides a keen Alien Certificate out of Subscription in addition to the compatible visa requirements