If you’re inside Ny or Nj and they are looking to consolidate personal debt, coverage a primary venture otherwise a massive, one-big date expenses, an MCU Family Equity Mortgage is helpful for you. In the place of an excellent HELOC, these types of loan offers a lump sum and you can fixed interest rate.

Apr = Annual percentage rate (Offered to Read more)

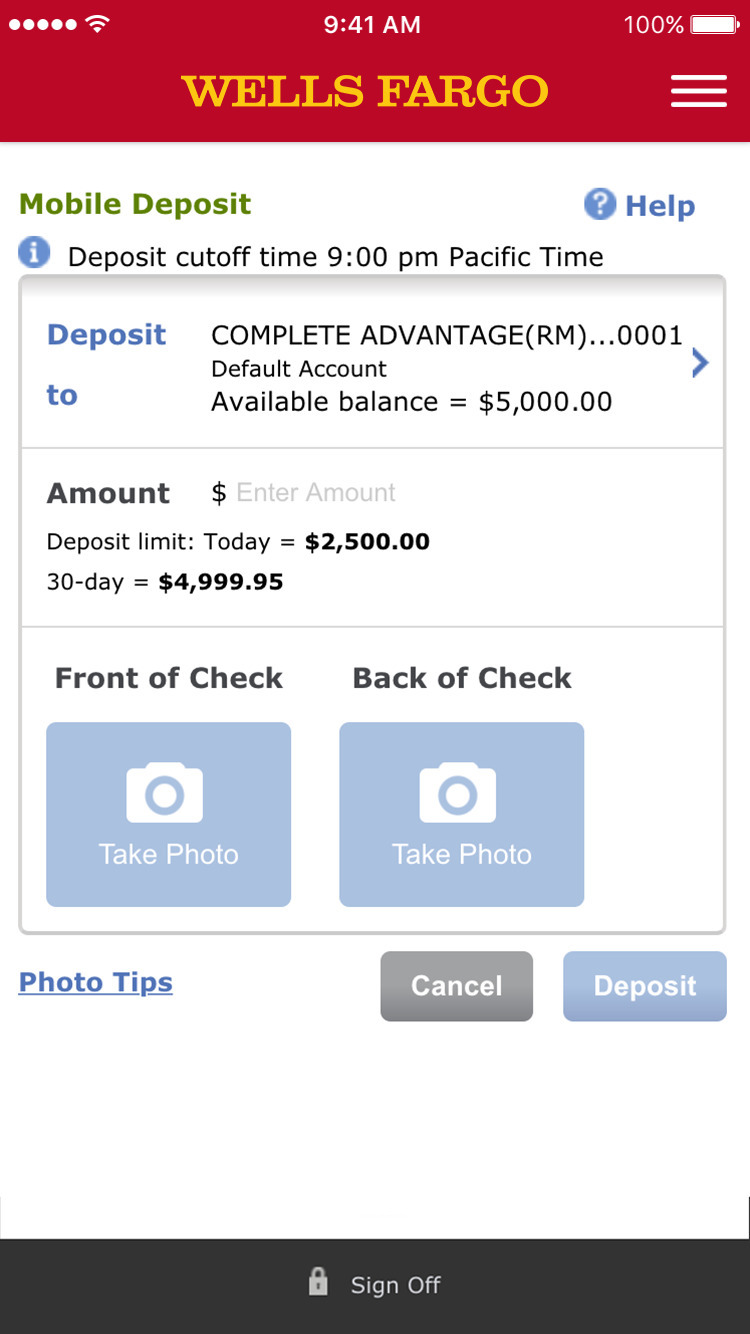

step one Considering mortgage levels of $fifty,000. The latest ount which may be borrowed try $5,000 and limit matter are $fifty,000. We’re giving loans you to consist of step one-a decade considering their comfortability and liking. There isn’t any maximum Loan-To-Value (LTV).

There are not any Closing costs Because of it Loan And all of Out Away from Wallet Costs For APPRAISALS Would be Reimbursed From the Closing.

Domestic Guarantee membership was protected of the a mortgage https://paydayloancalifornia.net/woodbridge/ on your own primary household. Assets insurance is requisite. Ton insurance policies may be needed if for example the home is in the an effective ton zone. Costs is high centered on applicant’s credit history. Costs and you can terms and conditions is actually subject to alter without notice. Certain limitations will get pertain. Registration is required.

(2) Said first household drops contained in this a minimal, reasonable otherwise middle census area region since scaled by the FFIEC website. Getting advice for you to pull this post at your home, excite click here to own directions.

(4) Should your domestic cannot fall in lower, modest or center census region area stated inside the section 3, you might still pre-qualify by having a family group earnings on or underneath the low so you can moderate measure. Continue reading…