Since the Homes and you will financial segments began to unravel, of several age might possibly be restricted on Housing marketplace or would spill-over towards the remaining portion of the benefit and you can subscribe a recession. While total financial styles during the basic half of 2007 searched to suggest that destroy would probably end up being confined on Housing market, the deterioration from the home loan and you can houses appears to have give to other groups. Research out of later 2007 and very early 2008 suggest that the tiredness was dispersed outside the housing industry and that this new economy’s wellness was at chance.

As a result in order to dilemmas on financial field, brand new Management has recently removed numerous measures to provide restricted rescue so you’re able to discourage property foreclosure and invite people with a good credit score chances to re-finance and you can to evolve money to maintain their property and get current to their costs

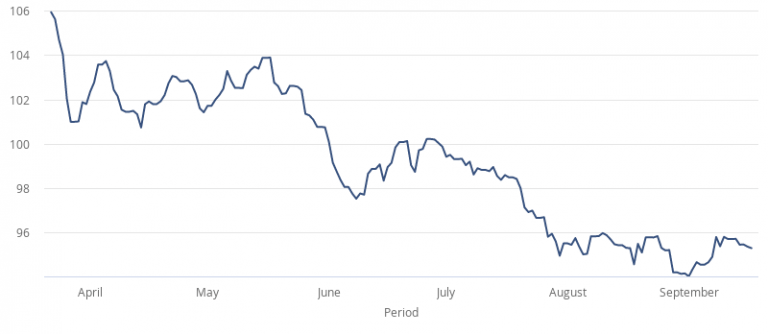

New Destruction Accelerates. S. savings has had into multiple days when you look at the previous numerous decades. Big borrowing from the bank crunches about middle-1960s, mid-seventies, very early mid-eighties, and you will very early 1990’s resulted in biggest declines when you look at the Homes creation and you can slowdowns otherwise recessions on the economic crisis. Continue reading…