An effective USDA financing are a government-supported, no-money-down financial created specifically having customers and residential property from inside the less-heavy places, plus outlying and you can residential district portion during the Florida.

If you are considering to buy a property away from urban areas, new USDA’s financial system can offer you several benefits, and additionally all the way down interest levels and you may money compared to other regulators-supported programs such FHA and Virtual assistant.

From inside the Florida, the latest USDA means the united states Institution away from Agriculture, an agency well known because of its wedding inside agriculture, forestry, and you may restaurants-relevant effort.

To determine when the a property is approved to own an excellent USDA financing, you could potentially relate to the newest USDA Qualification Map. Truth be told, 91 % of one’s United states, also various parts of Florida, drops in USDA boundary.

As a result while an initial-day family visitors thinking of buying a house away from metropolitan portion for the Fl, by using the USDA’s home loan program would be a viable choice.

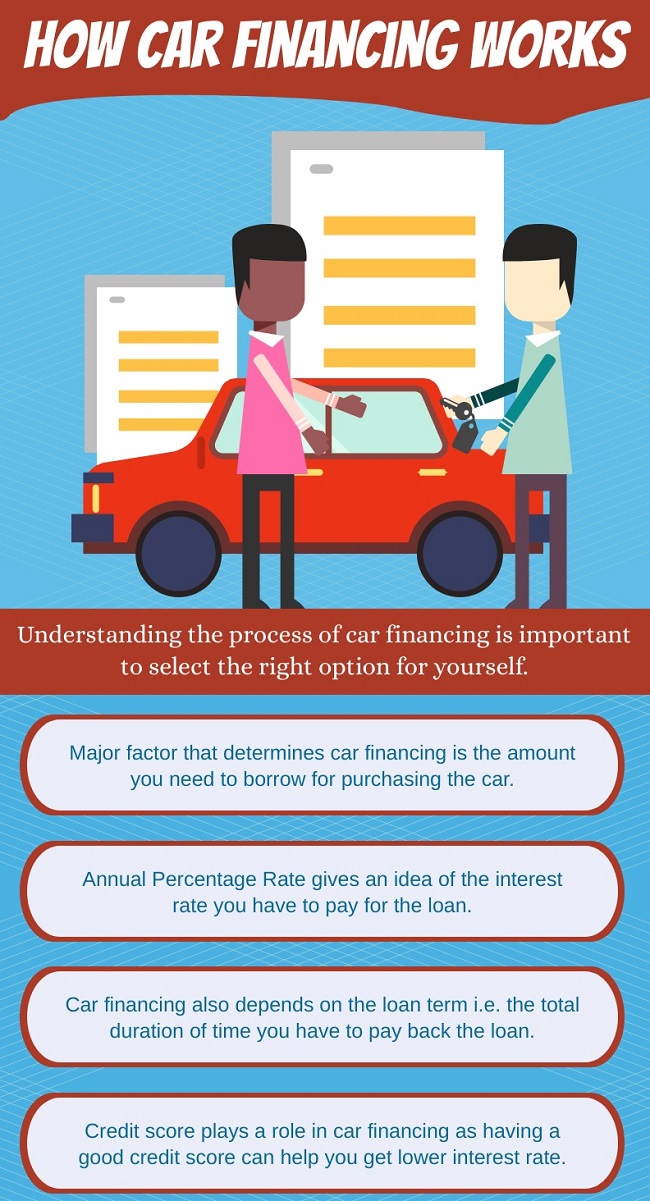

Why does an effective USDA Loan Works?

USDA finance from inside the Florida try collection of since they are protected by the fresh new U.S. Department of Farming, decreasing the risk to have mortgage lenders and you may letting them render all the way down interest rates. Such financing haven’t any prepayment charges, enabling individuals to settle the money very early without a lot more costs.

Considering the USDA make sure, these finance often have rates doing 0.50 fee issues below other low-down-percentage choices instance HomeReady, HomePossible, and you will Antique 97, also lower than Va mortgage loans, taking tall savings having homeowners.

How does New USDA Explain Outlying?

The phrase “rural” having USDA finance into the Florida hails from Part 520 from the fresh Housing Work regarding 1949.

Organizations maybe not conference such rural standards are known as “urban.” It is essential to note that no particular bodies meaning is obtainable getting suburbs otherwise exurbs. Hence, all the Us land fall under rural otherwise urban.

When you look at the 2020, the brand new Census Agency lead more standards to recognize between outlying and you may towns on quantity of census tracts. An outlying census tract means conference the following standards:

- This is simply not inside a 1 / 2-distance radius off an airport that have a yearly passenger count out-of 2,500 or higher.

USDA Qualification Chart

You should use so it USDA qualification chart to get a message and find out if property already matches the latest USDA’s possessions qualification requirements.

Using the USDA chart, you can rapidly determine whether a house we wish to buy might possibly be eligible for the application. Other areas qualified to receive characteristics changes annual consequently they are calculated from the people occurrence or any other issues.

An excellent USDA-acknowledged financial such MakeFloridaYourHome is be certain that brand new qualifications of all the qualities you prefer. To truly save your time on the attributes which could not be eligible, it is best to contact a great USDA-accepted lender to verify your target having online payday loans New Castle Delaware a beneficial USDA mortgage.

How can you Qualify for a USDA Mortgage?

Potential home buyers need certainly to fulfill particular criteria off property place and you may income to help you qualify for good USDA financing within the Florida. On top of that, they must see almost every other simple financial qualifications.

Assets Location

Our home ordered should be when you look at the a rural census area discussed because of the USDA. The fresh new property’s qualifications is going to be affirmed utilising the USDA site otherwise asking their mortgage lender.

Money Eligibility

Home buyers need to have a family earnings from inside the USDA’s given low to modest income constraints for their town. Such restrictions arrive towards USDA web site or are going to be received compliment of a dialogue that have MakeFloridaYourHome.

Credit history

Applicants are required to show a normal reputation of towards-day expenses payments, indicating their ability to deal with economic obligations effectively.