Now, we are plunge to your field of USDA money: what they’re, as to why these are typically an effective option for certain borrowers, and-lest we forget about-reasons why the loan could get denied. There’s a lot of right back-prevent blogs to focus on in terms of navigating the loan program, and therefore article deliver a very clear and you can to the stage publication to insights USDA fund and ways to make sure that your very own try approved. Thus sit-down and surely get yourself on board using this type of really academic help guide to USDA loans, and possess one-step closer to getting your fantasy family!

Grounds USDA Finance Gets Refuted

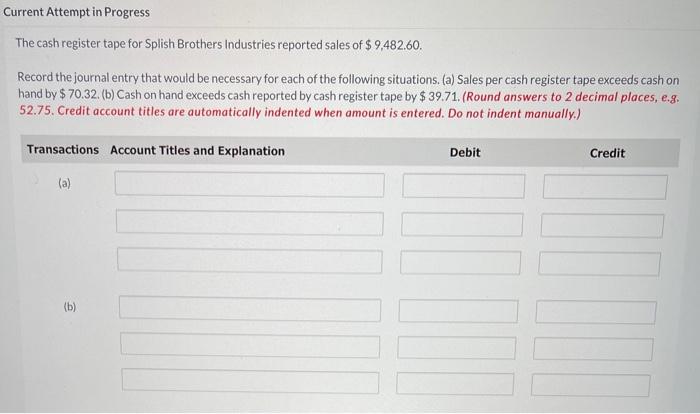

USDA finance are very found-immediately following due to their lowest cost, no advance payment requirements, and casual credit standards. Still, the loan you may still be refused when the specific criteria are not came across. Probably one of the most popular reasons for having assertion are money position. Having a great USDA mortgage in the The state, the average domestic income limit having a household of just one-4 anyone are $150,2 hundred as well as for a household of 5 or even more was $198,250. Also, USDA fund ount out of loans. The personal debt-to-earnings (DTI) proportion should be less than 41 percent so you’re able to qualify.

Simultaneously, the new applicant’s credit history you can expect to influence the outcomes. When the an applicant’s credit history falls less than 640 or implies late repayments, a lot of previous concerns, collections accounts, or other outstanding levels, this might trigger their financing as refused. Simultaneously, if they have maybe not based any credit history prior to now, they could https://www.cashadvancecompass.com/loans/255-dollar-payday-loan/ nevertheless meet the requirements as long as they are economically solvent.

For those interested in their fantasy family, having solid economic standing may help make procedure much easier. As a result, knowledge about prospective pitfalls just before getting into it travel is to establish indispensable for anyone shopping for a good USDA financing. Exactly what regarding the individuals with bad credit evaluations? How come affecting its chances of effortlessly getting that loan? Let’s delve into it now.

Candidates With Less than perfect credit Records

People that have poor credit records have long become named this new very vulnerable class with regards to searching an excellent USDA financing. You’ll be able to have candidates having poor credit to get a beneficial USDA financing when they understand and satisfy all of the conditions.

The newest USDA has stated that they’re happy to topic fund towards a situation-by-case base, even though individuals introduce an unfavorable credit score. With that said, people that have poor credit might need to give more content in acquisition to prove they can pay off their mortgage. As an example, lenders may need proof money and you will constant work, including documents of any types of house that will avoid defaulting towards mortgage further down-the-line.

Also, if loan providers decide to offer that loan even with a bad credit score, candidates should expect to expend higher interest rates compared to those which have best borrowing from the bank histories. Although this increases the general count repaid for the the end, delivering use of USDA financing you will indicate a lot of time-identity benefits if the individuals going and you will follow up making use of their repayments.

Income and you can borrowing conditions

When it comes to money and you will credit criteria, people need meet certain requirements so you’re able to receive a USDA loan. Minimal credit history towards the USDA Protected Financing Program is 640, however, prices on the mortgage is far more beneficial when you have a high credit rating. Lenders will account for other activities such as the amount of late costs, how many financing a borrower keeps discover, exactly how much debt as opposed to income can be found, or any other exposure affairs for the your credit profile in check to choose whether they are likely to default toward loan or not.