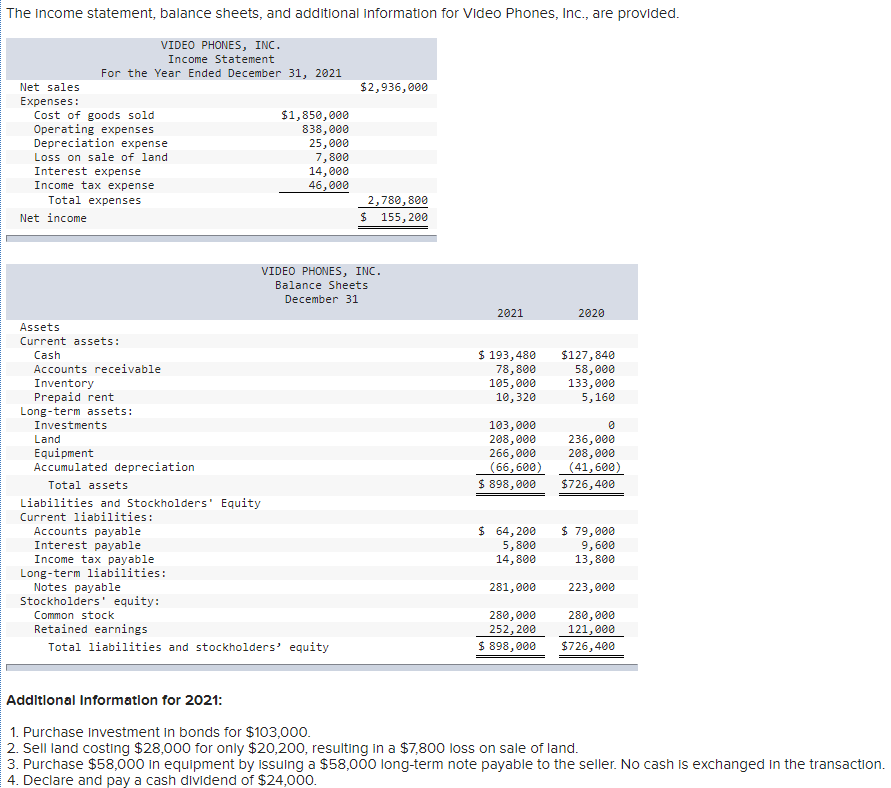

One of many trick standards to be eligible for a residential financial mortgage would be to tell you a two-season work previous performs record. This might be a problem getting present school students or high school graduates who simply graduated from high-school, university, or tech college or university. Many full-day pupils had no really works background while discovering fulltime. Have acquired money through authorities college loans household members, otherwise unusual and you will prevent short term perform. Specific college students, such legislation college or university and scientific school graduates were underemployed for more than seven otherwise 8 ages and you may had been elite college students. Continue reading…

instant payday loans no credit check

What is the best method to invest in a pole barn?

- When you have a premier credit history, you might be eligible for lower-rates and higher lending conditions.

- Based perhaps the mortgage is actually covered or unsecured, you could risk shedding your house.

- High-interest levels suggest could result in paying so much more than simply their barn deserves.

Playing cards

Particular aspiring barn people that simply don’t qualify for signature loans may move to playing cards to finance its structures, in fact it is a slippery mountain.

Benefits & Drawbacks

- You want a high credit rating to help you be eligible for an informed terms plus the lowest interest rates.

- You could be eligible for advantages factors otherwise frequent-flyer kilometers according to creditor.

- Rates of interest that have handmade cards can be extremely large and lost a fees shall be high priced.

If you’ve got enough cash in the financial institution to cover cost of a pole barn, which percentage experience likely how to go.

Positives & Disadvantages

- You will never need to bother about attract repayments otherwise monthly payments.

- Based on how much you have got spared, you could be stopping your entire nest-egg. Continue reading…

Zelensky went along to Me to find battle improve. His most-important friend shrugged

Vice-president Kamala Harris with Ukraine’s Chairman Volodymyr Zelenskyy, speaks into balcony of Eisenhower Professional Workplace for the the newest Light Home advanced when you look at the Arizona, Thursday, . (AP Photo)

Realization

- Ukrainian troops was slower losing soil, and you may authorities say more assistance is required to hold Russia back.

Nyc-This new tepid reception of Ukrainian Chairman Volodymyr Zelensky regarding U.S. recently launched the new narrowing alternatives which he face after 2? several years of conflict.

Zelensky touted his very-named earn package”-an effort in order to victory much more firearms and defense guarantees regarding the You.S. as well as partners to gain specific leverage over Russia-for the a good flurry from group meetings as he shuttled between Nyc and you may Arizona.

However, Biden government officials, a lot of time cautious about and also make actions one to Moscow you’ll perceive as escalation, indicated skepticism and told you they wanted more information. President Biden create a fresh tranche out of currently-accepted military assistance, but failed to grant Zelensky’s chief request: permission to help you hit into the Russia with extended-range missiles.

Previous President Donald Trump, at the same time, reiterated immediately following appointment Zelensky on Saturday one his priority was to seek an instant end on the combat which have a fair bargain for both sides,” rather than explaining how it will be reached. Continue reading…

Non Lender options which have bad credit mortgage brokers during the NZ

Pressures of having Lenders with Poor credit

Do you need to know more about providing home loans which have bad credit? Those with poor credit can find home loan apps hard given that its credit file get let you know new perception away from a business a deep failing, unexpected jobless, Covid, a separation, faster circumstances, a life threatening problems on members of the family otherwise abrupt adversity. Continue reading…

Moreover, an abnormally great number of subprime finance features defaulted after origination

Inside 2006, however, mortgage rates of interest struck four-season levels, the amount regarding family conversion process denied and also the rates of domestic rate really love decelerated or perhaps in some instances home prices decrease, leaving the most up-to-date subprime borrowers at risk of commission dilemmas. Subprime individuals having Fingers have observed the largest latest escalation in delinquency and you will foreclosure prices, if you find yourself best individuals knowledgeable little upsurge in delinquencies and you can foreclosure. Individuals is almost certainly not in a position to prevent sharp fee increases because the they might inside the prior to ages. However, that have enough time-name pricing surprisingly low prior to quick-label cost, this issue isn’t as acute as it might be lower than a historically far more regular setup interesting prices.

Actually consumers with plenty of security so you’re able to re-finance its varying price mortgages will get face challenge in search of that loan that have reasonable costs, once the interest levels is actually greater than inside the before many years

In many of those very early commission defaults, consumers prevented and come up with costs ahead of they encountered percentage surprises, recommending one to when you look at the 2006 some loan providers could have paid off their underwriting requirements when confronted with less debtor interest in credit. From the rapid expansion out of subprime credit in recent years, loan providers, people, and you can critiques organizations got minimal analysis in which in order to model credit exposure presented because of the brand new borrowers or book home loan designs, and so could have underestimated the risk in it. Continue reading…

six. Should i get a beneficial 15- 12 months otherwise a 30-season home loan?

- Financial charge in addition to origination, software, underwriting and you will document planning charge

- Identity charges in addition to term insurance rates and escrow will cost you

- Discount circumstances, which happen to be accustomed pick off less rates

Just how can financial affairs works?

If you have additional money about financial or even the merchant is offering to spend the the closing costs, you may want to buy financial points to get a lower rates. One point translates to 1% otherwise the loan matter, and will be employed to get off the rate of interest.

Your loan title is the period of time it requires to help you pay-off their financial. 30-seasons mortgages was common while they supply the reasonable payment pass on out over three decades. An excellent 15-season home loan cuts you to benefits time in 50 % of, helping you save thousands of dollars desire compared to the a longer name. – although tradeoff is actually a greater payment. But when you can afford you to definitely fee, you will find a plus: 15-year home loan prices are lower than 31-season home loan costs.

eight. Fixed rate instead of variable-speed mortgage: That is better?

When repaired financial costs is large, it could be worth every penny to adopt a changeable-rates mortgage (ARM). Sleeve prices are less than repaired home loan cost throughout the an enthusiastic initially teaser months one lasts between one month and you will ten years. However, just like the teaser price months closes, your own rate and percentage might have to go up (or perhaps in some instances go down) if the adjustable-speed period initiate.

8. What is the best very first-go out homebuyer mortgage in my loans in Belle Fontaine situation?

There are various financing apps to choose from, therefore the correct one to you personally is dependent upon your own personal finances. The newest desk lower than provides an introduction to just who usually advantages from each type out of financing system. Continue reading…